Are you struggling with your current mortgage back-office processes and looking to automate your processes so that you can achieve high levels of accuracy? Do you want to combine the best of technology and automation so that you can reduce your operational expenses? Are you struggling to articulate what you would like to achieve from your upfront commitment of time, money, and effort into automated solutions for your mortgage process? Are you looking to leverage the services of a reliable and experienced provider of mortgage automation solutions? If so, we can help.

Outsource2india (O2I) is a leading mortgage outsourcing company. We have developed a proprietary mortgage automation tool by leveraging our combined 50+ years of servicing the mortgage industry. Having served over 100 lenders/services over the last decade, we have a thorough understanding of the processes and nuances in the industry, and this has fueled the development of our MSuite automation tool. With this tool, our clients have been able to get access to a highly scalable solution that provides for high accuracy and cost savings. Besides, lenders/servicers can also speed up their processes significantly.

Mortgage Automation Support Services We Offer

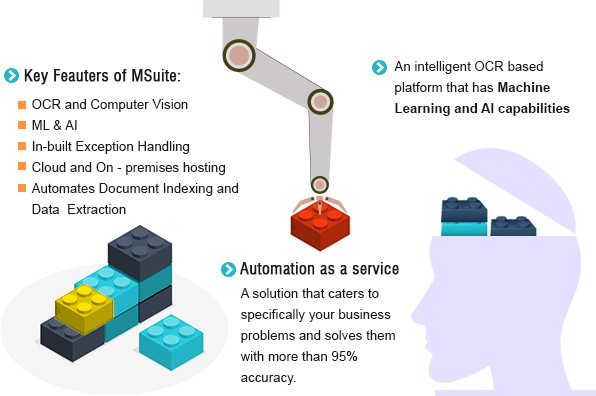

When you outsource mortgage automation services, we can render intelligent document capture and processing solutions to capture and commit the needed support at each rung of the loan and mortgage document ladder, including loan origination, processing, underwriting, closing, delivery, servicing, and packaging. We make use of a suite of components in our proprietary mortgage automation tool - called MSuite. MSuite has the following 5 features that make it possible to automate several processes. These components include -

Connector

This component allows MSuite to receive data inputs from a variety of sources, including -

- API Integration

We have given MSuite the ability to receive transactional information from a wide variety of sources, including many different internal/external systems, servicing systems, 3rd party vendor systems, and various LOS systems. - Emails

MSuite can receive and process transactional information from emails. MSuite can identify transactional information in the body of emails and then process it further, or even connect to external systems based on information in the body of the email. For instance, if an email is generated due to the uploading of a new document into the LOS/servicing system, MSuite can track the email alerts and process the relevant transactions. - SFTP

If documents are being uploaded in an SFTP, MSuite can monitor relevant hot folders and process relevant transactions that have been uploaded there. - Direct Uploads

MSuite also has a provision for users to directly upload transactions that need processing through an intuitive UI.

- API Integration

Indexing Engine

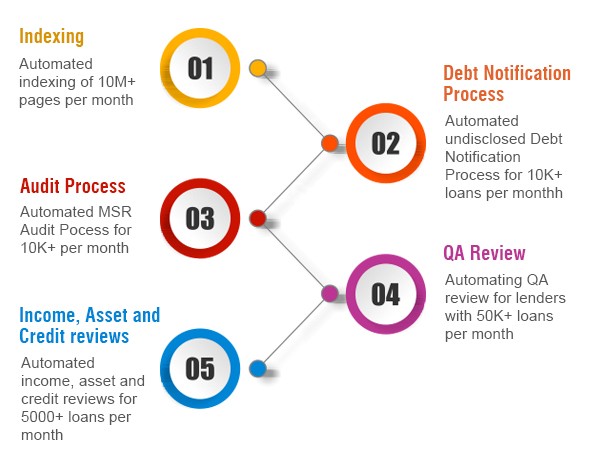

MSuite has an advanced indexing engine that allows it to address real-world document quality problems. It can classify documents accurately, including those with low scan quality (up to 150 DPI). Using a combination of machine learning, OCR, and computer vision, MSuite can recognize over 350 types of documents, including those with varied formats. MSuite’s automated workflow has an accuracy of more than 95%, making it one of the best in the industry.

Data Extraction Engine

MSuite has an accuracy of over 98% thanks to its powerful data extraction engine. With this capability, lenders/servicers can extract data automatically from a variety of documents, like closing docs, income, collateral, etc., to ensure that the chances for incomplete or wrong data capture are mitigated. MSuite also provides for exception handling when the OCR confidence of data points is less than 90%. With digital data, there is no need for exception handling since the accuracy is always 100%.

Rules Engine

MSuite has a sophisticated and dynamic rule engine that can efficiently and effectively manage thousands of rules as well as perform many different types of QA reviews and other complex tasks like calculating income and underwriting files. MSuite also provides the ability to maintain and update processes to meet evolving business needs and regulatory requirements.

Reporting Engine

MSuite has been provided with a state-of-the-art reporting engine that can generate detailed trend analyses and reports of all tasks that have been automated. Using MSuite, we can provide standard reports as well as custom ones to meet dynamic business needs. MSuite can report on virtually any data point that is stored in the system.

MSuite Implementation Infographic

MSuite - An Automated Solution for All Your Mortgage Processing Needs

Over 60% of the tasks related to the mortgage process are prep tasks, which do not require direct user interventions. Thus, retail lenders, investors, wholesale lenders, service providers, and private mortgage insurance companies are looking for a solution that can transform their operations, reduce costs, provide necessary scalability, and digitize their mortgage lending process. One such solution is Outsource2india's MSuite.

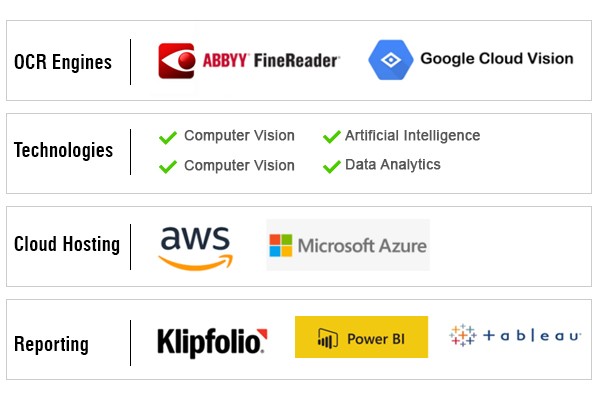

MSuite is platform agnostic and can leverage additional cutting-edge and modern technology when needed.

MSuite relies on the following to automate your back-office mortgage processes

MSuite can go through the scanned images, split and upload them to their respective folders, extract data from various documents, perform stare and compare, raise exceptions wherever needed, and provide low per loan cost-saving solutions while complying with the federal regulations. MSuite can automate the entire UDN process, acquire and integrate data from the internal and external system, provide a seamless customer experience, and achieve more accurate loan processing. You can easily implement this solution into your back-office operation and eliminate the unnecessary clutter of papers, reduce turnarounds, save significant cost.

MSuite - Mortgage Automation, RPA Tool

Benefits of Choosing O2I for Mortgage Automation Support

When you outsource mortgage automation services to O2I, you will get a substantial edge over your competitors. We ensure compliance-friendly back-office support for mortgage loan services through our extensive experience in the mortgage support industry. Here are just a few of the many benefits of outsourcing mortgage automation services to us -

High Quality

Outsource2inida is an ISO 9001-certified organization that assures high-quality mortgage automation solutions. Our loan processing team is highly motivated to help you with your closing challenges and inquiries. With their broad knowledge of the mortgage industry, they can connect with your customers emotionally and factually.

State-of-the-art Infrastructure

At O2I, our team of mortgage automation executives has access to modern infrastructure in the form of world-class office spaces, uninterrupted network equipment, and state-of-the-art call center tools and technologies.

Multiple Delivery Centers

We have over 10 delivery centers and four global workplaces. It allows us to work in partnership with you when and where you need it. Moreover, our call center executives work day in and day out across all the time zones to cater to your needs and questions.

Flexible Pricing Options

You can collaborate with us on a requirement basis. With our flexible-pricing option, you get the advantage of choosing the scope and duration of the mortgage loan support services from us. Our customized mortgage automation services enable us to focus on your pain points.

Industry Expertise

Our assorted knowledge of mortgage automation and over 27+ years of service experience give substance to our trustworthiness and allow us to competently get ahead of the changing demands and render industry-wide best services.

24/7 Availability

Our team of call center support executives is available 24/7. When you partner up with us, you can be certain that our contact center professional will always be available for calls during your work hours, regardless of the time zone difference.

Economy of Scale

At O2I, we have the required resource competence, both in terms of expertise and support. You can depend on us for any spike in your business demands.

Client Success Stories

O2I's MSuite Improved Loan Packaging and File Review for a US-based Lender

Get the complete picture of the complex challenges faced by the client and how they could overcome issues through our MSuite tool.

Read more

O2I's MSuite Improved Indexing & Reduced Dependencies for a US-based Lender

Check out this case study that encompasses the MSuite solution which O2I offered to a New Jersey Client for automating indexation. This case study outlines complex challenges and cutting-edge solutions based on automation.

Read moreOutsource Mortgage Automation Services to Outsource2india

Customer Testimonials

Thank you, everyone and I look forward to being even more impressed by your team in the future.

VP, Corporate Operations,Appraisal Company, Detroit, MI More Testimonials »

Outsource2india has been a pioneer in providing high-value mortgage automation support services and a series of other mortgage closing support solutions to its global clientele. At O2I, we have an extended suite of mortgage automation professionals who can provide you with a high level of scalability & flexibility, which can be customized based on your service needs. We have in-depth knowledge and understanding of US mortgage and federal laws.

We have rendered our services to the exact requirements of retail lenders, investors, wholesale lenders, service providers, and even private mortgage insurance companies. We continuously evolve and modernize our mortgage automation process to deliver immeasurable value to our clients.

Get in touch with us today for reliable, efficient, and cost-effective mortgage automation services.

Get a FREE QUOTE!

Decide in 24 hours whether outsourcing will work for you.

Have specific requirements? Email us at: info***@outsource2india.com

USA

116 Village Blvd, Suite 200,

Princeton, NJ 08540

116 Village Blvd, Suite 220, Princeton, NJ 08540

135 Camino Dorado, Suite 7, Napa, CA 94588.

Mortgage Automation Support Services FAQs

-

Should I Get an Adjustable- or Fixed-Rate Loan?

If you are betting on falling interest rates to save money, ARMs are better, but if you are comfortable with a fixed interest until you pay off it may be wiser to choose a fixed-rate loan.

-

How Do I Check My Free Credit Report?

Every taxpayer is entitled to get a copy of credit report for free of cost once a year from any three recognized credit report companies.

-

Should I Refinance My Mortgage?

You may consider refinancing your mortgage if:

- You are positive about your eligibility

- If running rates are lesser than your original interest

- If you plan to keep your home for 5+ years

-

What's Included in a Monthly Mortgage Payment?

Your monthly instalments include insurance, tax, principal, and interest. The principal amount is what you pay to clear the outstanding loan.