Finance and Accounting Services in the Philippines

Avail expert finance

and accounting

services.

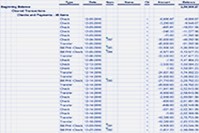

Whether it is a small-scale business or a large multinational company, financial statements are important and can never be underestimated. These financial reports and statements are usually prepared on a monthly, quarterly, or annual basis and allow the related stakeholders to quickly gauge how well the business is doing and how it compares to the previous year. Based on the business or the type of organization, financial statements are often called by different names while serving the same purpose. This includes income statements, balance sheets, cash flow statement, statement of stockholders’ equity, fund flow statements, etc. Numbers revealed through these financial statements play an important role in decision making and help the leadership group to adjust to market demands swiftly.

At Outsource2india, we have more than a decade of experience in working with businesses and investment funds and offering them with the highest quality financial statement preparation services. We possess the requisite technical skills, and the knowledge required to prepare financial reports in a timely manner.

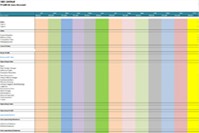

At O2I, we have a select team of individuals who are experts in preparing financial business statements and have a strong asset management background. They are also experienced in both US IFRS and GAAP reporting and have worked with a variety of different fund structures. Our services include -

We can prepare thorough complied financial statements as necessitated by your company’s management. In this case, we do not verify the accuracy of the numbers and therefore do not hold ourselves responsible for the numbers, but at the same time ensure no accounting errors are present in the financial report. We make corrections and then present the same in a standardized format, complete with a balance sheet or income statement, but without any disclosures or footnotes.

Reviewed financial statements require a higher level of service and is more detailed and thorough than a normal compiled statement preparation. We check the integrity of your data and perform additional inquiries to identify items that require further analysis. We take extreme effort to understand the nature of your business and your goals, which help us to prepare financial reports that look beyond the numbers and tell the whole story.

When you outsource financial statement preparation services to us, we also provide expert accounting services which can help you develop your own systems to generate financial reports. Our teams are trained in handling various accounting software such as QuickBooks® Pro, and can assist you in the initial setup, training, or development of the accounting system. We also help you introduce cloud-based financial accounting to help you gear up for the future, while ensuring your financial statements are always prepared before time and with 100% accuracy.

Apart from the above, we also offer the following services -

From a simple business loan to complex income statements preparation, at O2I, we specialize in putting together high-quality financial reports within short turnaround times. Accounting standards are different worldwide, and changing regulations means you need a partner who is always on the top of his game when it comes to preparing your financials. Some of our key differentiators include -

View All

View All

View All

View All

View All

View All

View All

View All

At Outsource2india, we understand how time-consuming is it to prepare a financial statement, and given today’s cutthroat business nature, financial statements are prepared monthly to take swift decisions. Our financial statement preparation services are therefore extremely well-suited to both small and large businesses, and can provide you with the following benefits -

At O2I, we believe in providing top-notch finance and accounting services to clients across the globe which are not only affordable but also suits your regulatory requirements. We have 18+ years of experience in serving over 18488 customers globally. Outsourcing financial statement preparation services to India can help you save almost 60% on your operating costs.

So, if you have decided on outsourcing financial statement preparation services to India, look no further. Get in touch with us and experience the O2I advantage!

Decide in 24 hours whether outsourcing will work for you.

Have specific requirements? Email us at: info***@outsource2india.com

116 Village Blvd, Suite 200,

Princeton, NJ 08540