Finance and Accounting Services in the Philippines

Avail expert finance

and accounting

services.

Are you struggling to get accurate numbers on balance sheets and income statements laid out by non-specialized financial analysts? Is your struggle with banking financial analysis further compounded by calculation of total interest income instead of net interest income by inexperienced analysts? If so, we, at Outsource2india can help you get an accurate deposit and interest rate spread reports without lifting a finger.

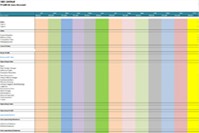

Outsource2india has 27 years of experience in banking financial analysis services where we put our best financial minds to the task. We work closely with our clients to understand their requirements and challenges in carrying out banking financial analysis. At O2I, we proactively scan values from annual 10K and balance sheets to analyze net interest income, non-interest income, total interest earned, net income, securities, loans, deposits.

Outsourcing Banking and Finance & Accounting Services streamlines operational processes, reduces cost, complexity, and maximizes revenue for banks. In addition to these benefits, banks also get a local perspective by understanding the specific needs of customers in different locations. They can use financial performance analysis of banks to differentiate products and get ahead of the competition. Our banking financial analysis services cover -

We can help you keep your finances spic and span. Our team of financial analysts will thoroughly check entries and statements to ensure balances match the statement. Our team can perform payroll processing, ledger reconciliation, accrual and prepayment adjustment, book-closure at the end of financial term and other functions.

Our analysts can identify shortfalls in documents and provide recommendations to remediate the errors if any. Our agents will help you follow up on payments owed by borrowers. We will accelerate the collection of interest so you can improve your revenue stream.

We help you keep track of the inward and outward cash flow as well as close gaps in spending. All that is made possible with accurate financial projections and budget forecasts. We will acquire your financial data to perform number crunching. The findings will be compiled into powerful insights that enable you to efficiently manage the cashflow.

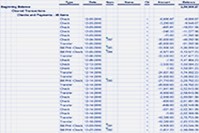

Inaccurate assessment of accounting, financial, and management reports can lead to complications that can come in the way of profit-making stride. If you have internal records of finance management, we will ensure that the bank statement meets the bookkeeping records that are maintained internally. If a mismatch in balances is found, we will flag the data for reconciliation. Further, we will provide reconciliation support to close the gap in reports.

View All

View All

View All

View All

View All

View All

View All

View All

Our Banking Financial Analysis services are perfect for small-medium sized banks and Loan production offices. Our experts deal with loans between $0.5m – $15m. Our process is highly transparent and provides precise instructions to help our team to execute banking financial analysis without errors. outsourcing banking financial analysis services lets you experience the following process -

In the first step of the financial analysis, our analysts at O2I collate and review source data. These are the source documents that we review -

Once all the data has been reviewed, the experts analyze all the data that has been collected. Banking financial analysis service outsourcing will see our analysts performing the following functions -

In this stage, the financial analysts at Outsource2india prepare the credit report and share it with the banks.

We deal with analysis for different types of loans including -

Why worry about hiring a full-time financial analyst when you can outsource banking financial analysis services to O2I at fraction of the cost of a full-time analyst? Plus, we offer you the flexibility to scale and customize banking financial analysis services so that your bank's income is higher than expenses. Here are several top reasons why choosing a banking financial analysis services provider like us could enhance your productivity -

A banking financial analysis service providing a company like Outsource2india is the choicest partner for big and small banks looking for partners who offer financial analysis for the banking industry. Outsourcing financial analysis for banks is simply the best solution to consider especially if you are cost-conscious and are concerned about accruing unnecessary overhead.

The security of our client's data is a matter of great concern to us. Therefore, we take the best security measure to keep your data secure. Our teams have signed the non-disclosure agreement. Thus, making sure you can trust the analysts working on your sensitive financial data. Our combined efforts to ensure best data security have earned us the ISO/IEC 27001:2013 certification.

Our banking financial analysis services are designed with quality in focus. We ensure that every key parameter is considered for an accurate analysis of your yearly statement. Our quality control team evaluates the analysis report to ensure it is error-free. We are therefore an ISO 9001:2015 certified banking financial analysis services provider that values your time and money.

O2I has a team of qualified Chartered Accountants, (certified public accountants) statisticians with doctoral degrees and people with MBA (Finance) from reputed institutions. They keep themselves up to date with global trends using various methods. They peruse online journals and link-up with reputed CFAs abroad. Their comprehensive industry knowledge and experience can be effectively tapped to determine the performance and fiscal accountability of an organization.

If you have a tight deadline, we can help you avail reports on time for making timely decisions. Our analysts have the potential to work in tight shifts to complete the analysis of banking and financial data.

The banking financial analysis services can be scaled with flexibility because at O2I, we have the bandwidth to deal with analysis requirement however complex the challenge.

We offer a single point of contact who ensures that your concerns, if any, are heard and addressed without being made to wait. Our project head will reach out to you and provide the necessary support in a personalized manner.

We are adept at using the best banking financial analysis tools. Our team regularly uses the state-of-the-art analytics tool to read, analyze, and distinguish the data.

Get round-the-clock support from our agents to help you out in nearly all circumstances. You can reach us through your preferred channels to get instant support.

A transportation management company was glad we helped them with accounts payable service. We helped the client streamline their revenue stream.

Read more

We handled SEC filings for small publicly-listed companies, which helped them reduce their turnaround time and save costs.

Read moreWhen you outsource banking financial research to Outsource2india, you are trusting an experienced partner with two decades of experience in some of the most challenging and complex banking financial analysis and accounting services. We have had service requirements from several big and small banks across the world. Our banking financial analysis has helped the client to make better decisions and enhance their compliance without rocking their boat.

Contact us to tell us about your requirements for financial analysis services for banking and our customer engagement team will get back to you within 24 hours.

Decide in 24 hours whether outsourcing will work for you.

Have specific requirements? Email us at: